ROMGAZ published Quarterly Report on the Economic-Financial Activity of ROMGAZ Group on September 30, 2025

The full version of the Quarterly Report on the Economic-Financial Activity of Romgaz Group on September 30, 2025 (January 01, 2025 - September 30, 2025) and the Condensed Consolidated Interim Financial Statements for the nine-month and three-month periods ended September 30, 2025 (unaudited), prepared in accordance with International Accounting Standard 34, as adopted by the European Union, are available on company’s website www.romgaz.ro – Investors – Interim Reports and on Bucharest Stock Exchange website.

ROMGAZ GROUP PERFORMANCES

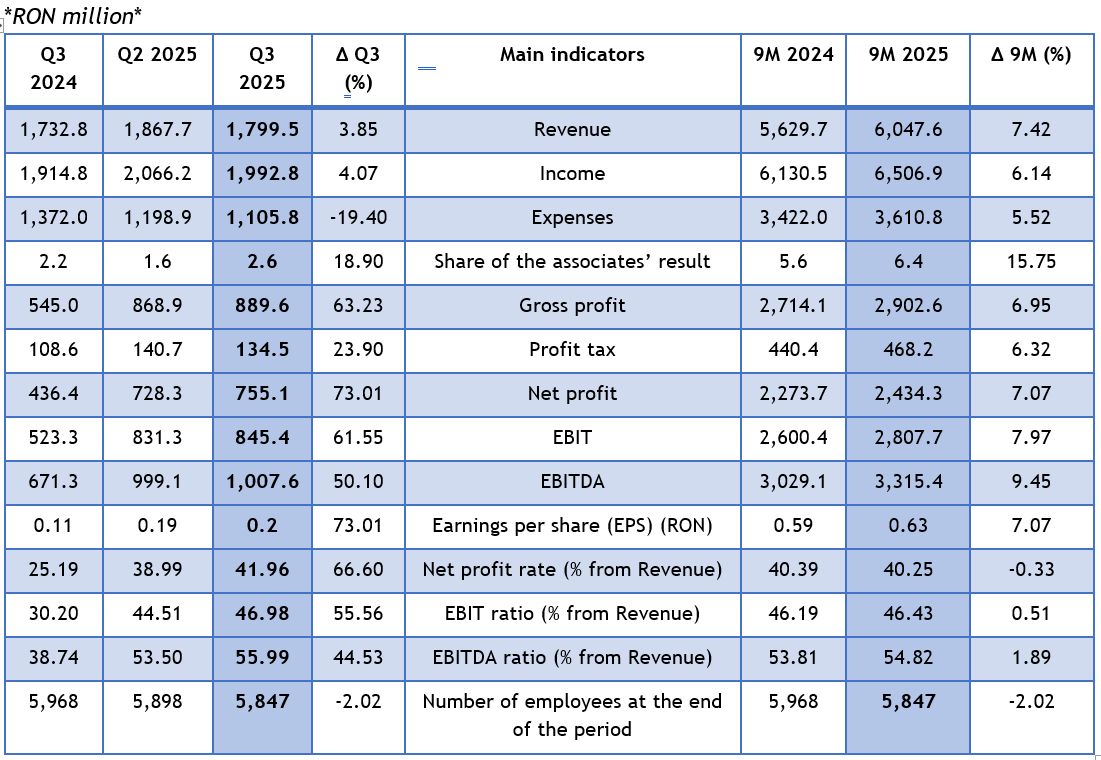

ROMGAZ Group keeps high operational and financial performances in the first nine months of 2025.

Consolidated net profit per share (EPS) was RON 0.63.

Margins of the main profitability indicators on September 30, 2025: net consolidated profit (40.25%), consolidated EBIT (46.43%) and consolidated EBITDA (54.82%) continue to keep at high levels (September 30, 2024: 40.39%, 46.19% and 53.81% respectively).

For the reporting period, Romania’s estimated natural gas consumption was 72.16 TWh, approximately 2.5% higher than the consumption recorded in the similar period of 2024, of which around 22.79 TWh was covered by import gas and the difference of 49.37 TWh by domestic gas.

For the first nine months of 2025, ROMGAZ total deliveries, on the domestic market, represented 54.89% from the national estimated consumption, 3.3 percentage points more than in the same period of last year. Concurrently, ROMGAZ natural gas deliveries from internal production on the Romanian market, represented 80.23% from the national consumption covered with gas from internal production.

Natural gas production for the first 9 months of 2025 (9M 2025) was 3,676.0 million m3, by 0.1% higher than production recorded in the similar period of 2024.

Condensate production at 9M 2025 increased by 56.9% as compared to the same period of 2024.

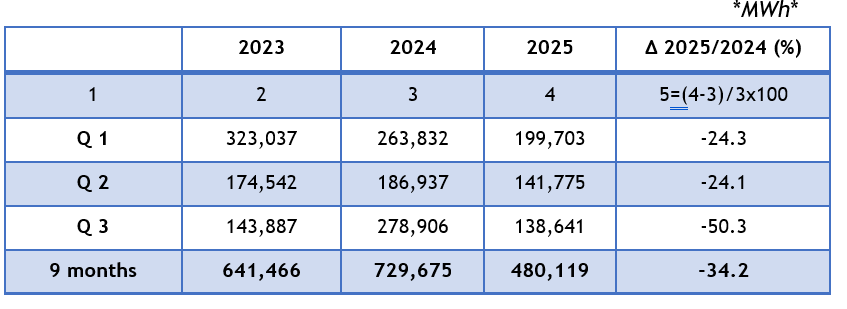

Electricity produced in the reporting period was 480.1 GWh, 34.20% less (249.6 GWh) than in the same period of last year.

ROMGAZ produced in Q3 2025, 138.6 GWh electricity, lower by 140.3 GWh, namely 50.29% less than in Q3 2024.

Relevant Consolidated Financial Results

A brief overview of the Group’s main indicators during the 9M period ended September 30, 2025:

Total revenue for the reporting period is higher by RON 376.42 million, recording a rise of 6.14% due to the following factors:

increase of revenue comes mainly from an 8.25% increase in revenue from gas sales (RON 5,247.93 million in the nine-month period ended September 30, 2025, as compared to RON 4,847.76 million in the similar period of last year), generated by the 12.4% increase of delivered gas quantities, compared to the same period of 2024;

revenue from electricity sales decreased by 20.16% (RON 245.03 million in the nine-month period ended September 30, 2025 as compared to RON 306.92 million in the similar period of 2024) to 34.77% lower quantities sold;

consolidated revenue from underground storage activities increased by 15.74% (RON 432.14 million in the nine-month period ended September 30, 2025, as compared to RON 373.37 million in the similar period of 2024), due to the increase of consolidated income from injection services (+53.29%). On September 30, 2025, the capacity booked was 30,709,000 MWh (100%), storage filling degree is 93.80%.

Consolidated net profit of RON 2,434.33 million achieved in January-September 2025, was by 7.07% higher, namely by RON 160.68 million, as compared to the similar period of 2024. The consolidated net profit for Q3 (RON 755.09 million) was by 73.01% higher than in the same period of last year due to reduced expenses by 19.40%, the fiscal outcome being visible, expenses with taxes and duties decreased by RON 316.67 million.

Operational Results

In the first 9 months of 2025, ROMGAZ produced a total hydrocarbon volume of 23.96 million boe, by 0.14 million boe (0.61%) higher volumes than in the similar period of 2024.

Gas production for 9M 2025 was influenced by:

Completion of investment works to extend the productive infrastructure that led to streaming in production 5 new wells;

Significant number of wells were reactivated by performing specific investment works in wells;

Production optimization of wells with highest production potential;

Continuous rehabilitation projects of the main mature gas reservoirs, these projects aim to maximise natural gas production and to increase the recovery factor.

Caragele field had a significant contribution on the production level in the first 9 months of 2025, by streaming in production new wells in the high depth area and performing specific investment works in wells.

National estimated natural gas consumption for Q3 2025 was 14.21 TWh, approximately 1.68% lower than the consumption recorded in Q3 2024, of which 7.87 TWh was covered by import gas and the difference of 6.34 TWh by domestic gas. For this period, ROMGAZ delivered on the domestic market 12.24 TWh, representing 86.12% of the national consumption.

The volume of gas sold by ROMGAZ in the reporting period, representing deliveries to customers, without CTE Iernut consumption, increased by 12.4% as compared to 9M 2024.

The volume of electricity produced as shown in the table below is in close connection with the energy demand, the evolution of prices on competitive markets and the quantity of natural gas allocated to the production of electricity and the efficiency of said activity.